Introduction:

Pricing and reimbursement in the healthcare industry are pressing concerns all over the world, and Latin American countries (LAC) are not an exception to this rule. In addition to the COVID-19 pandemic, the increasing availability of highly specialised drugs that come with expensive price tags has resulted in an enormous amount of strain being placed on healthcare systems. As a consequence of this, countries such as Chile, Mexico, and Peru are having discussions about drafting laws to restrict the prices of medicines. In this study, we explore how Latin American countries can learn from European experiences in regulating pharmaceutical prices and reimbursement.

Pricing and Reimbursement in Latin America:

The challenge in pharmaceutical pricing and reimbursement in Latin America with healthcare services, including medicines, are primarily financed through out-of-pocket expenses. Around two-thirds of medicine funding comes from household incomes, creating a significant barrier to access. The lack of public funding and limited experience in pricing policies for medicines contribute to the high prices of medicines in Latin America. This, in turn, leads to higher out-of-pocket expenses, further exacerbating the problem of accessibility.

European Experiences:

In contrast, European countries have made significant progress towards universal health coverage. They operate a national health service or a system based on social security contributions or a mix of both. The European experience of regulating pharmaceutical prices and assessing medicines as part of their reimbursement decisions could provide valuable insights for Latin America. However, it’s crucial to understand that European countries apply a wide variety of different pharmaceutical policies, and each comes with its own set of success factors and potential pitfalls.

Case Studies: Brazil, Colombia, Ecuador, El Salvador, and Mexico:

Brazil, Colombia, Ecuador, El Salvador, and Mexico have made strides in implementing price regulation mechanisms. For instance, Brazil, a major medicine producer, established price regulation in 2003 in response to rising medicine prices. Colombia, on the other hand, implemented a pricing regulation system based on external reference prices in 2013. Ecuador introduced a price regulation mechanism based on external price referencing in 2014, while El Salvador established a drug pricing mechanism in 2012. Finally, Mexico set a maximum retail price for patented drugs in 2005, although this mechanism has faced challenges due to its voluntary nature and lack of sanctions for non-compliance.

Pricing Policies in Europe:

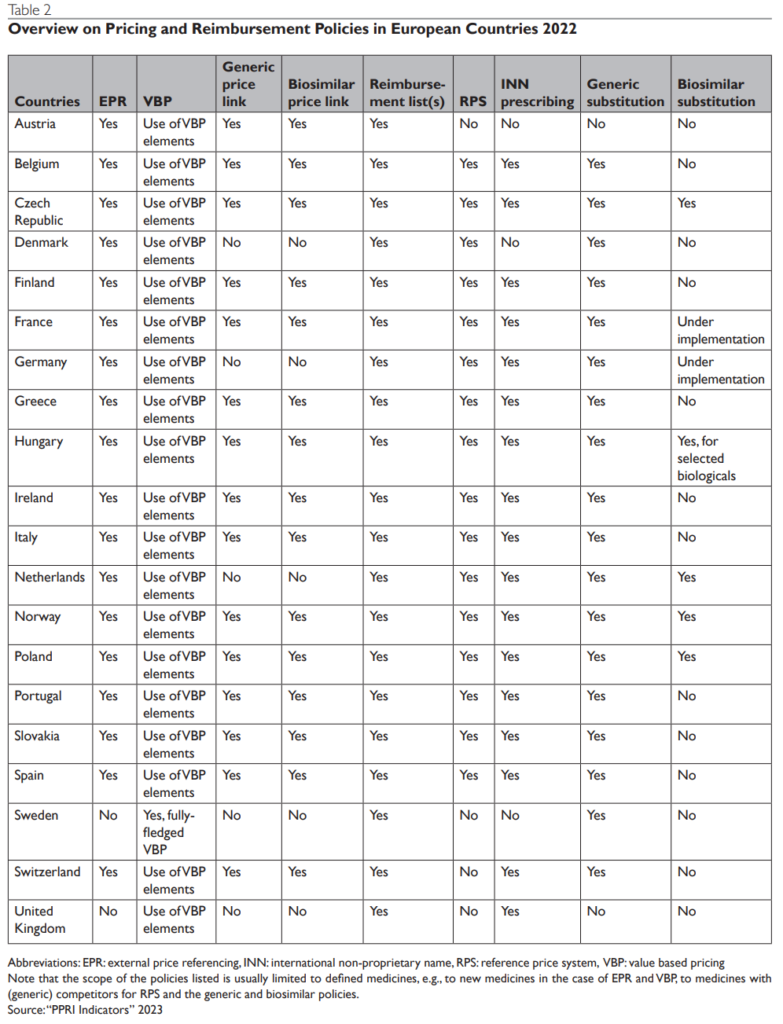

European countries apply a variety of pharmaceutical pricing and reimbursement policies, which are aligned to the specificities of the medicines. Some of the commonly applied policies include external price referencing, health technology assessment, and generic and biosimilar policies. Each of these policies has its benefits and limitations, and their effectiveness can depend on the specific context and implementation.

Conclusion:

European countries’ experiences in pharmaceutical price regulation and medicine assessment could offer valuable insights for pharmaceutical pricing and reimbursement in Latin America. However, we must remember the uniqueness of each country’s context and healthcare system. While we can learn from other countries’ experiences. We must tailor these lessons to fit each Latin American country’s specific context.