A Snapshot of the South African Medical Scheme Landscape

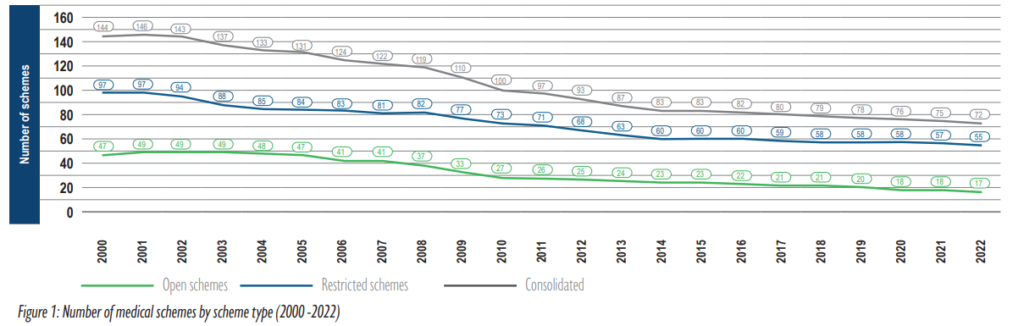

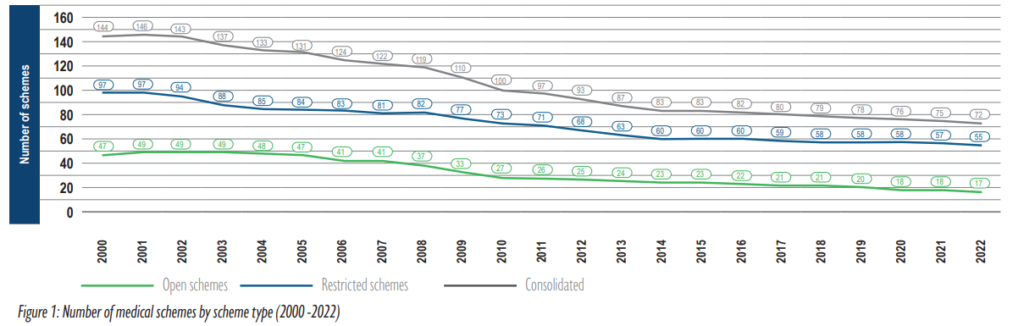

The latest Council for Medical Schemes (CMS) industry report offers an insightful look into the South African Medical Scheme Landscape utilisation and benefits paid to service providers for 2021-2022. This vital data serves as a benchmark for medical schemes, helping them gauge their performance within the industry. The results, however, should be interpreted with caution as statistics were collected through a Dynamic Database Driven Annual Returns (DDDR) system rather than actual financial information. The total number of registered medical schemes has been on a downward trend, dropping from 144 in 2000 to 72 in 2022. Mergers between medical schemes, such as Hosmed Medical Scheme with Sizwe Medical Fund, and Quantum Medical Aid Society with Discovery Health Medical Scheme in 2021, and Nedgroup Medical Aid Scheme with Bonitas Medical Fund in 2022, contributed to this decrease. As of 2022, there are 17 open and 55 restricted schemes.

Unpacking the Demographic Characteristics

The report reveals a slight increase in beneficiaries, with female beneficiaries dominating the landscape. The prevalence of Chronic Conditions Diseases List (CDL) also saw a slight rise, with females being the most affected group. Gauteng emerged as the province with the highest proportion of beneficiaries 39.01%, followed by the Western Cape 15.49% and KwaZulu-Natal 14.21%. In 2022, open schemes accounted for more than half of the total medical scheme population of 4,86 million beneficiaries (53.77%), while restricted schemes accounted for 4,18 million (46.23%).

Analysing Healthcare Benefits and Expenditure

The total healthcare expenditure on benefits paid in 2022 increased by 6.34%, rising from R205.3 billion in 2021 to R218.4 billion. The majority of these benefits, 90% to be exact, were risk benefits, which also saw an increase of 6.37%, from R185.3 billion in 2021 to R197.1 billion in 2022. Additionally, the average amount spent from medical savings accounts per beneficiary per year increased by 5.51%, reaching R2 374.48. The report further highlights the distribution of healthcare expenditure, with the majority spent on hospital services with 35.46%. This was followed by spending on all specialists, which accounted for 27.03%, then medicine dispensed at 15.53%, and supplementary and allied health professionals at 8.11%.

When looking specifically at risk benefits, hospital services accounted for 39.15% of the expenditure, followed by specialists at 27.94%, medicine dispensed at 12.94%, and supplementary and allied health professionals at 7.07%.

In contrast, expenditure from medical savings accounts was most commonly used for medicine dispensed, accounting for 39.49% of the expenditure. This was followed by spending on specialists and supplementary and allied health professionals, both at 17.76%, and general practitioners at 12.92%. Only a small proportion, 1.30%, was spent on hospital services.

The Rise in Out-of-Pocket Payments

Out-of-pocket (OOP) payments in the South African Medical Scheme Landscape climbed from R27.2 billion in 2015 to R39.7 billion in 2022, representing a 5.57% yearly increase. Members in open schemes face a higher proportion of OOP than members in restricted plans. It is worth noting that the actual out-of-pocket payments might be higher than reported, as medical schemes may not capture all costs associated with healthcare seeking.

The Utilisation of Healthcare Services

The report also focuses on mental health, maternal and childcare, and healthcare service utilisation. Notably, there was a rise in the number of beneficiaries experiencing depression, a decline in immunisation coverage, and an increase in the number of mammograms and pap smears paid for. These findings underscore the need for a more value-based healthcare approach, focusing on preventive measures and early intervention.

Hospital Admission Analysis

In 2022, hospital admissions increased across the board compared to 2021, with private hospitals (A&B-Status) seeing the most significant rise. The number of admissions to these hospitals rose from 2.0 million in 2021 to 2.2 million in 2022. Provincial hospitals also saw a substantial increase in admissions, with figures jumping from 205,804 in 2021 to 271,035 in 2022.

Interestingly, the growth in admissions was more pronounced in open medical schemes, while restricted medical schemes saw a decline. Despite the increase in admissions, the average length of stay in all hospital facilities decreased in 2022, ranging from a 3.13% to 48.09% decline. Day clinic admissions also increased, with figures rising from 20.86 per 1000 beneficiaries in 2021 to 24.22 per 1000 beneficiaries in 2022. This rise was primarily due to more admissions for patients enrolled in open medical schemes.

Contribution Increases for 2023

In 2023, the average increase in contributions for all medical schemes was 6.8%. Restricted medical schemes, also implemented a 6.8% increase in contributions. On the other hand, open medical schemes, increased contributions by slightly less, at 6.7%.

Comparing these increases to the rate of inflation gives us an idea of how affordable these medical schemes are becoming. The South African Reserve Bank predicted that inflation would average 5.7% in 2023. However, the actual average increase in medical scheme contributions was 6.8%, which is 0.7% higher than the projected inflation rate.

This pattern of contribution increases exceeding inflation is not new. It was common before the COVID-19 pandemic and appears to have returned in 2023. The gap between the rate of increase in medical scheme contributions and the rate of inflation is a concern, as it could make private health services less affordable over time.