The report titled August 2024 Pharmaceutical Industry Foreign Trade Analysis (Ağustos 2024 İlaç Endüstrisi Dış Ticaret Analizi), published by Pharmaceutical Industry Employers’ Association of Türkiye, provides a detailed analysis of Türkiye’s foreign trade, focusing particularly on the pharmaceutical industry. This “August 2024 Pharmaceutical Industry Foreign Trade Analysis” offers key insights into the performance and dynamics of Türkiyes’s pharmaceutical foreign trade within the context of its overall trade landscape.

General Foreign Trade

Over a 12-month period, Türkiye’s total exports increased by 3.5% compared to the previous period, reaching $261.8 billion.

Pharmaceutical Industry Trade

The report specifically highlights the performance of the pharmaceutical industry in foreign trade. Here are a few key metrics:

Import and Export Dynamics: The report likely includes an analysis of both import and export trends within the pharmaceutical sector, providing insights into the industry’s trade balance and key markets.

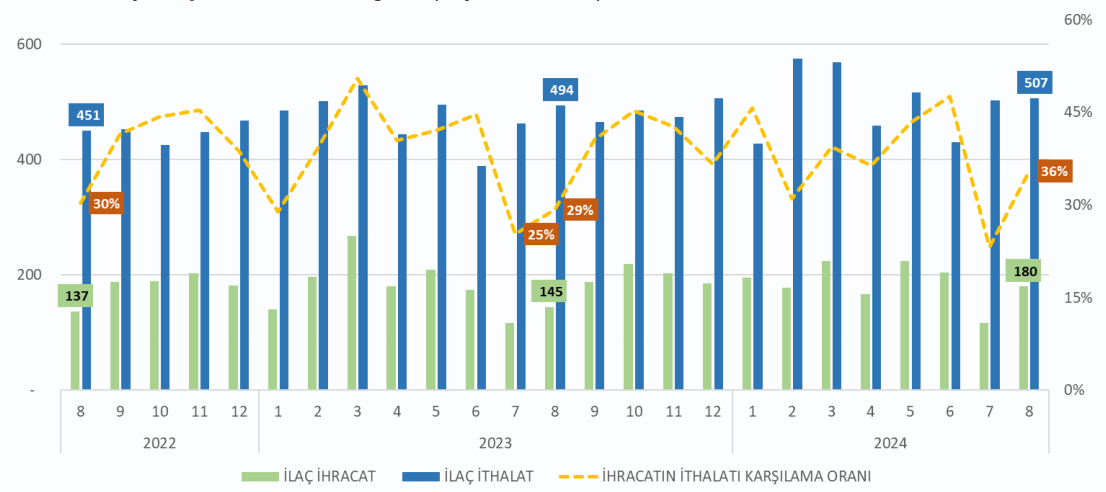

Export Performance: The pharmaceutical industry’s export figures are analysed in detail. In the first eight months of 2024, Türkiye’s pharmaceutical exports rose by 4.3% to 1.4907 billion USD, while imports increased by 4.9% to 3.9891 billion USD, resulting in a trade deficit of 2.4984 billion USD and a coverage ratio of 37.4%. Over 12 months, pharmaceutical exports grew by 4.4% to 2.29 billion USD, and imports rose by 5.8% to 5.9 billion USD, leading to a 3.6 billion USD trade deficit and a 38.6% coverage ratio.

Market and Product Analysis

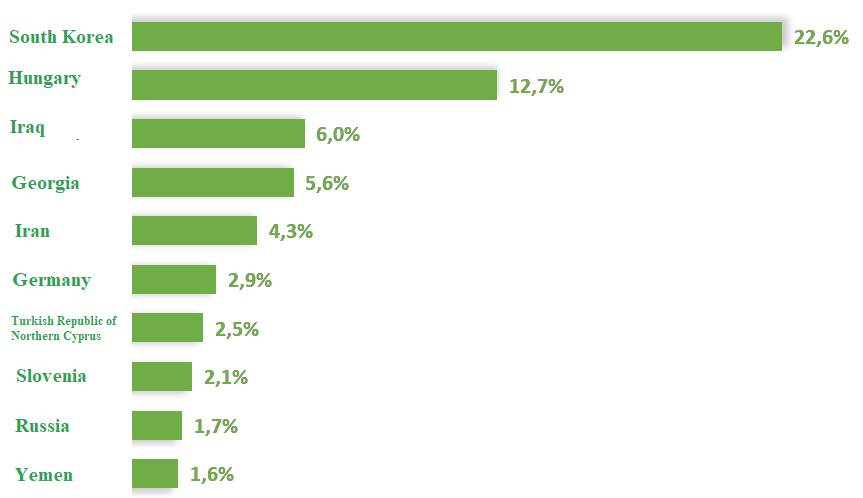

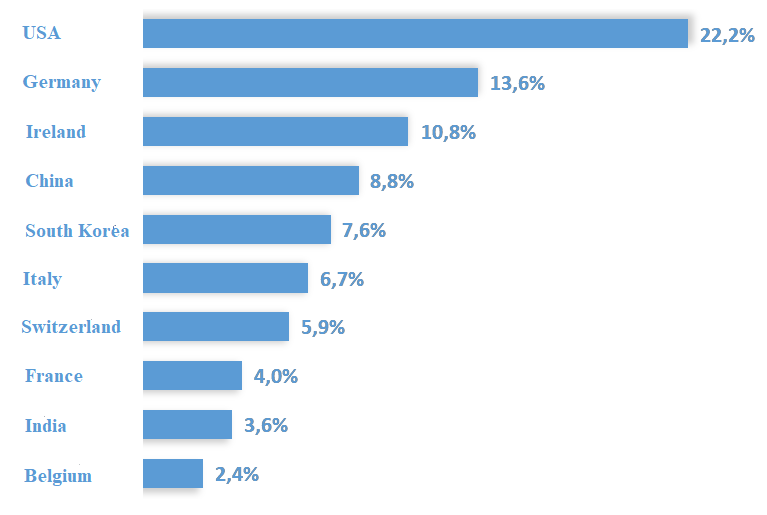

The report includes an analysis of the main markets for Turkish pharmaceutical exports and imports, as well as the types of pharmaceutical products that are most traded. As of August 2024, South Korea, Hungary, and Iraq are the top three destinations for pharmaceutical exports from Türkiye, with Asia accounting for 45.3% of the export market. During the same period, 63.2% of pharmaceutical imports to Türkiye came from Europe, with the United States, Germany, and Ireland being the top three import sources.

Economic and Policy Context

The analysis might be set against the broader economic and policy context, including any government initiatives or global economic conditions that affect the pharmaceutical industry’s trade activities. A more detailed report discussing changes in market trends, regulatory impacts, and other factors influencing the pharmaceutical industry’s foreign trade would be beneficial for fully understanding the current situation of the pharmaceutical industry in Türkiye.

To fully grasp the insights presented within this “August 2024 Pharmaceutical Industry Foreign Trade Analysis,” it would be necessary to read the complete report, as the summary provided does not include all the specific details and data points covered in the analysis.