Introduction

The Europe MedTech sector plays a critical role in changing the world’s health care. In addition to being ranked second in terms of volume after the US, it stood at $159 billion in 2023 and is expected to grow at an annual rate of 4.2% from 2024 to 2028. This paper outlines why Europe is still an attractive MedTech innovation hub in spite its weaknesses.

Advantages of the Europe MedTech Sector

1. Government support and strategic initiatives

The MedTech industry in Europe receives strong backing from national governments and the EU. In order to promote invention, countries like Belgium, France, Germany as well as Spain provide their companies with subsidies and tax relief. The EU4Health program has set aside €5.3 billion for this purpose alone thereby underlining its commitment towards public health which emphasizes on being prepared during emergencies while also improving digitalization in healthcare systems among other things.

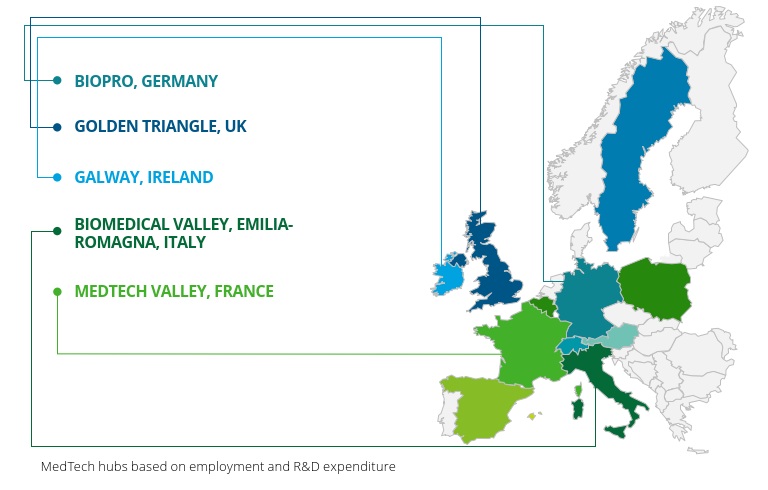

2. Robust Ecosystems & Innovation Hubs

Europe is home to various influential MedTech clusters such as Medicon Valley and The Golden Triangle. These clusters enable universities collaborate with startups and established companies in research projects leading not only to high patenting rates but also prolific publication outputs. For instance 42% of all global patents related to medical technology were filed within Europe compared with 35% in America.

3. Skilled Workforce & Education

Life sciences education offered by European universities is consistently ranked among the best in the world. Compared to Japan or China, Europe invests a larger share of its GDP into education. Moreover, initiatives like European Skills Agenda further enhance skill development thereby ensuring that there will always be a steady supply of qualified personnel for the MedTech industry.

4. Higher-level Medical Care Systems

The European healthcare systems are characterized by wide coverage of medical services; high consumption of primary care facilities over hospitals; minimal bureaucracy or paperwork in treatment processes. Because of these characteristics, it means that nearly all people can access healthcare they need when they need it without any discrimination which is an environment where new medical technologies can be adopted easily.

Moreover, the focus on community-based medicine coupled with health equity creates chances for MedTech companies to come up with solutions targeting various population groups.

Issues Affecting The Industry

1. Funding and Investment Gaps

There are funding gaps for risky investments despite great achievements made so far. In 2021, America got $6.7 billion from venture capitalists while Europe only managed to raise $2.1 billion something that significantly hindered commercialization of innovations as well as made local startups less attractive for mergers and acquisitions.

2. Regulatory Complexity

The process of certification for medical devices such as MDR IVDR among other things has become more complicated than it was before due to their strictness; this mostly affects smaller enterprises which may not afford meeting all requirements set thus being forced out by bigger players eventually driving them towards areas with friendlier legislations on innovation development .

3. Shortage of Skilled Personnel

Although the continent has a strong education base, it is likely to experience shortage of professionals in the field of MedTech because a large proportion of its population who have been working as healthcare experts are expected to retire soon. This in turn will aggravate talent scarcity considering that over 60% businesses across EU member states reported lacking employees with digital ICT skills last year alone .

4. Underfunding and Reimbursement Delays

European healthcare systems are less funded than those in other regions of the world. The time it takes to be reimbursed for a product varies greatly from one country to another within the EU, often lasting several years. As a result of this intricate process, smaller manufacturers are dissuaded from participating while the release of new technology is delayed.

Strategic Recommendations for the Europe MedTech sector

1. Standardizing Regulations and Reimbursement

Simplifying administrative requirements through creation of a single market for digital healthcare as well as aligning regulatory frameworks could speed up market entry. In addition, setting out clear guidance coupled with fast track routes for novel medical devices will attract more businesses into investing in Europe.

2. Improving Funding Mechanisms

Initiatives such as European Tech Champions Initiative aimed at bridging the late-stage growth finance gap could help address funding challenges. Further efforts might involve public-private partnerships or increased government funding among others in attempts to narrow down this disparity.

3. Nurturing Talent Development

Policy making at EU level needs to concentrate on drawing and keeping MedTech skills within its borders. Favorable immigration legislations, better working environments and continuous education plus training programs funded based on industry requirements should form part of these strategies.

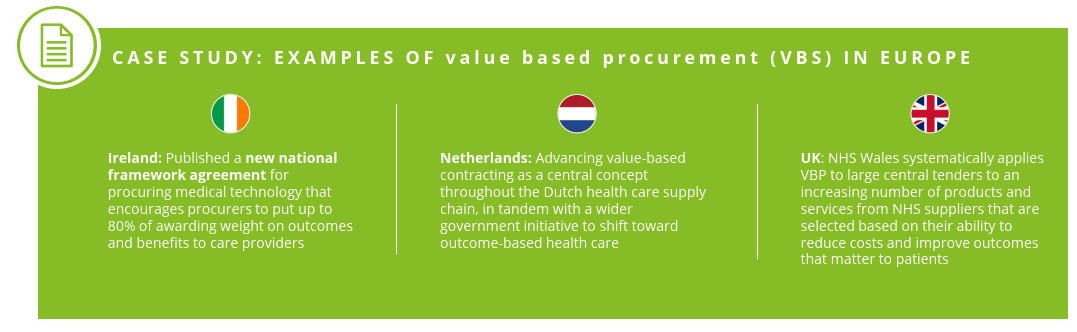

4. Advocating for Value-Based Procurement

Adoption of value-based procurement methods wider spread application will lead to more holistic pricing structures that promote use and creation of innovative medical technologies. The key in achieving such goals lies with making sure VBP practices are standardized across all Member States.

Summary

The MedTech sector of Europe has great potential because of its strong supporting systems, innovative centers, and a developed infrastructure for healthcare. To keep up the progress and be competitive on the global market, it is necessary to overcome such problems as financing, legal control and attracting specialists.